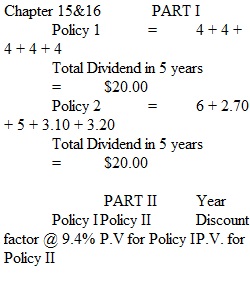

Q Create an Excel spreadsheet to organize your answers to the following problem, and submit your Excel file as an attachment by clicking on the appropriate button on this page. A company is considering the following two dividend policies for the next five years. Year Policy #1 Policy #2 1 $4.00 $6.00 2 $4.00 $2.70 3 $4.00 $5.00 4 $4.00 $3.10 5 $4.00 $3.20 Part 1: How much total dividends per share will the stockholders receive over the five year period under each policy? Part 2: If investors see no difference in risk between the two policies, and therefore apply a 9.4% discount rate to both, what is the present value of each dividend stream? Part 3: Suppose investors see Policy #2 as the riskier of the two. And they therefore apply a 9.4% discount rate to Policy #1 but a 14% discount rate to Policy #2. Under this scenario, what is the present value of each dividend stream? Part 4: What conclusions can be drawn from this exercise? PreviousNext

View Related Questions